The Rise of Crypto-eCommerce

Safex Blockchain realizes Satoshi’s abandoned eCommerce dream, but with privacy features from Monero. True P2P sale of goods & services is now a reality.

Following the creation of the ARPANET in 1969, eCommerce technologies have been demonstrated since the 1970’s. With the invention of dial-up Bulletin Board Systems and other software, niche eCommerce sites existed way back in the 1980s. But, it was only after Tim Berners-Lee created the first web browser in 1990, the WorldWideWeb, that the eCommerce industry really had the technology-base to establish itself and grow. But is blockchain technology where eCommerce heads next, and what factors will affect its adoption by the general populous?

Historic Online Sales Growth

Two of today’s most well-known online sales platforms, Amazon and eBay, were both launched in 1995. The Internet triggered a paradigm shift in not only how products could be sold, but the amount of customers that could be reached.

The growth in the eCommerce industry, from the 1990s to today, has been astronomical:

- 1999 - global eCommerce reached $150 Billion in annual turnover.

- 2017 - global eCommerce transactions generated a total of $29.267 trillion, with $3.851 trillion being retail (Business-to-Consumer, or B2C) sales.

- 2023 prediction - thanks, in part, to the COVID-19 pandemic, annual eCommerce B2C sales are expected to reach $6.5 trillion.

Resistance to Change

Some computing experts gave the Personal Computer Industry little scope for widespread adoption when the first models launched in the late 1970s (see quote below). Some people seem blinded by a desperate, illogical need to hold onto pre-existing technology systems.

This resistance to emerging technologies is nothing new. History has shown, time and again, that some knowledgeable people can be very wrong:

- Telephone: From 1876, Sir William Preece, then Chief Engineer at the British Post Office - “The Americans have need of the telephone, but we do not. We have plenty of messenger boys.”

- Cars: From 1903, the President of the Michigan Savings Bank to Horace Rackham, Henry Ford’s Lawyer - “The horse is here to stay but the automobile is only a novelty - a fad.”

- Computers: From 1943, Thomas Watson, President of IBM - “I think there is a world market for maybe five computers.”

- Television: From 1946, Darryl Zanuck, an executive at 20th Century Fox - “Television won’t be able to hold on to any market it captures after the first six months.”

- Personal Computers (Home PCs): From 1977, Ken Olsen, founder of Digital Equipment Corporation - “There is no reason anyone would want a computer in their home.”

It would seem that some people are more - and others are less - likely to embrace and use new technology when it becomes available. Or maybe some people, regardless of their knowledge and experience, just don’t see the potential, when others can. I wonder whether the same phenomena isn’t true with current blockchain technologies.

New Technology Adoption

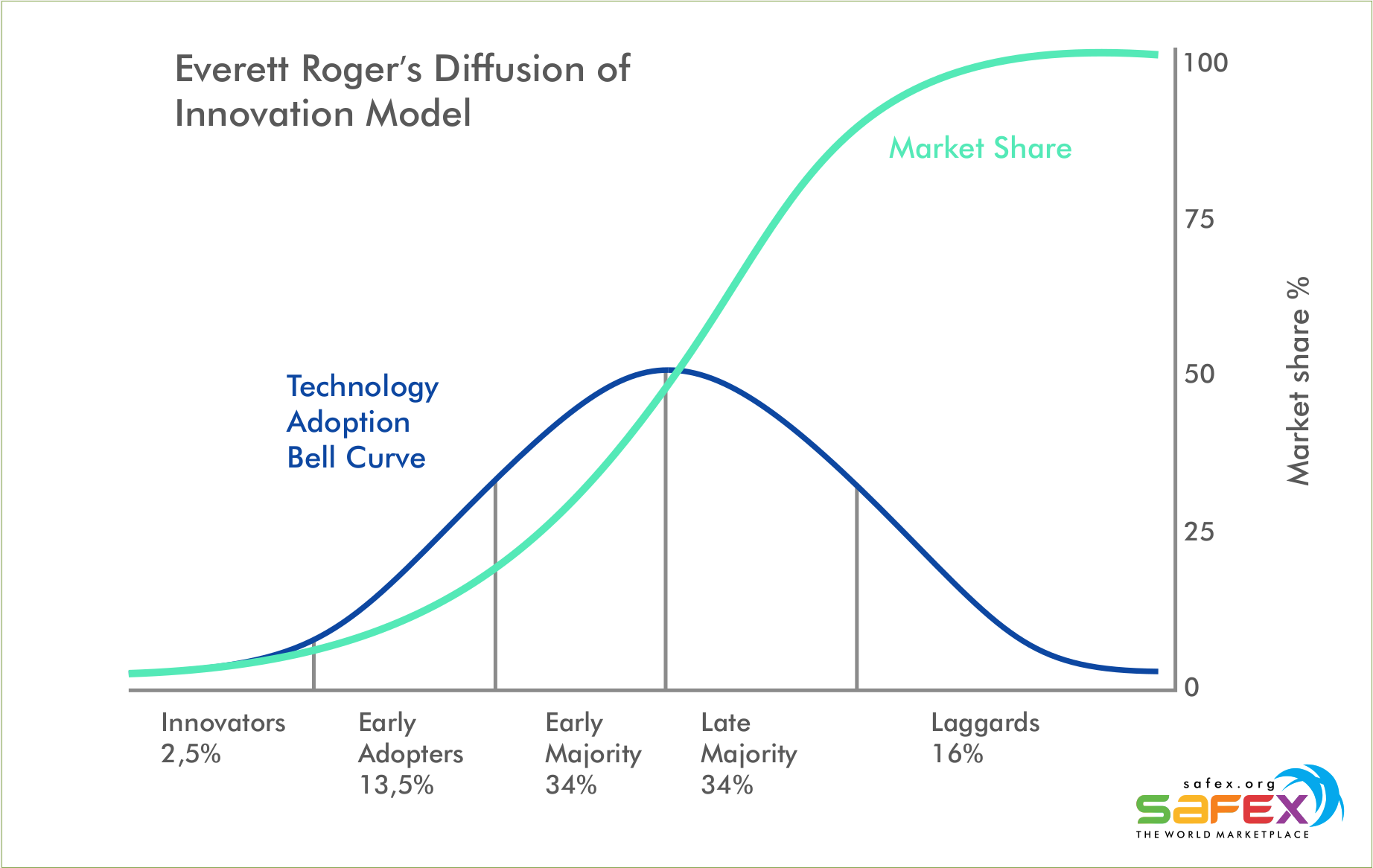

This disparity in the preparedness of people (and organizations) to adopt new technologies was synthesized into a theory by Everett Rogers in 1962. Rogers’ Diffusion of Innovations theory outlines the How/Why/Rate of a new technology (or idea) being spread within a population.

He proposed 5 elements that influence the rate of adoption, what pushes a new technology past having just niche appeal, and what is needed for something to reach that critical point, which leads to mass adoption.

The 5 elements are:

- The innovation itself

- Adopters

- Communication channels

- Time

- A social system

Within the Adopters category, a given population is broken into:

- 2.5% Innovators

- 13.5% Early Adopters

- 34% Early Majority

- 34% Late Majority

- 16% Laggards

It has been theorized (Geoffrey Moore, 1991, “Crossing The Chasm”) that the tipping point from niche technology to mass adoption occurs at some point between Early Adopters and Early Majority.

Taking into consideration all 5 elements of Rogers’ theory (listed above), there's a somewhat predictable timeframe over which an innovation diffuses through a population. The adoption process itself is broken into 5 stages:

- Knowledge/Awareness - become aware of the new technology

- Persuasion - gain interest in it

- Decision - choose to actively evaluate it

- Implementation - choose to trial the technology first hand

- Confirmation/Continuation - choose to use it

Looking back through history, it seems obvious why newer, more useful technologies replace the older ways of doing things. Transportation is an excellent example, where faster, safer, more comfortable methods of conveying people or goods were invented, and then subsequently improved upon, over time. The improvements and iterations a new technology undergoes, as it transforms from a new invention to a mass adopted product, is significant.

Entering the Blockchain Era

And now we arrive at the dawn of a new technology - blockchain, or distributed ledger technology - the fundamental breakthrough behind cryptocurrencies. Launched by Satoshi Nakamoto in the wake of the 2008 Global Financial Crisis, Bitcoin was the first Peer-to Peer (P2P) electronic cash system to get adoption traction. As explained in his Bitcoin Whitepaper, the goal was to “allow online payments to be sent directly from one party to another without going through a financial institution”.

Satoshi didn’t simply create Bitcoin out of thin air. He drew on decades of past work in the field of cryptography (see the Bitcoin Whitepaper bibliography) and the cypherpunk movement, which began in the 1980s. One of the key goals for bitcoin, and a core belief of the cypherpunks, was privacy. Unfortunately, being built on a public ledger means that every transaction is visible, along with the Bitcoin balances on every public key (Wallet Address). This means a single identifiable transaction can allow access to all past and future transactions, along with the user’s wallet balance. In section 10 of the Bitcoin Whitepaper, Satoshi suggests that privacy can be maintained by keeping public keys anonymous. This is a limiting factor in bitcoin’s practical application in eCommerce, and possibly explains why the bitcoin code related to on-chain eCommerce protocols was never implemented.

Although not commonly discussed, the deleted bitcoin code included the following eCommerce protocols:

- Users

- Market

- Products

- Reviews

The fact that the unimplemented eCommerce code exists in the Bitcoin github repository clearly shows that Satoshi saw the potential role cryptocurrency could play in ecommerce. However, just like the first automobile wasn't suitable for mass transport, the first cryptocurrency turned out to not really be suitable for use in eCommerce. As I touched on earlier, early technology breakthroughs often have limitations to functionality, and require improvements and new iterations, evolving over time to deal with the identified shortcomings and flaws.

Privacy Concerns

In this case, privacy is the key issue with Bitcoin as an eCommerce vehicle. A person can’t use Bitcoin for eCommerce without both the buyer and seller being able to see the other party’s wallet balance and all other transactions. Creating a new wallet address (ie. using a different public key) for each transaction has been proposed as a possible solution, but the reality of moving bitcoin through an anonymising service to a new wallet address for every transaction adds a level of complexity (and cost) to the process. This limits its viability for mass adoption in eCommerce, particularly from the Seller’s perspective, where merchants likely want to list their entire catalog of products, and creating a new wallet address for each and every item is prohibitively complex.

In recent years, general data privacy within the eCommerce industry has become a point of contention by many privacy advocates. Some of the issues include:

- eCommerce giants selling customer data

- database hacks and customer data accessed

- anti-competitive behavior by the eCommerce platform providers against the merchants using their platform

- different product prices displayed, based on a customer’s past purchases or geolocation

- customer details being withheld from merchants

The above abuses of data privacy could be resolved with the removal of any self-interested middleware platform. Blockchain technology, being decentralized and able to function as a trustless intermediary, has the potential to solve these issues. However, cryptocurrency technology had to evolve beyond what Bitcoin offers.

The addition of data encryption protocols is necessary to help increase data privacy, especially for wallet balances and transaction history.

A Privacy Leap with Monero

Launched in 2014, some 6 years after Bitcoin, the Monero cryptocurrency introduced technological improvements to overcome many of the privacy concerns identified in bitcoin. Thanks to the CryptoNote protocol, conceived by Nicolas van Saberhagen in his 2013 Whitepaper, Monero wallet balances are not publicly visible. Additionally, with the implementation of other improved cryptography techniques, such as Ring Signatures and One-Time “Stealth” Addresses, transaction details are obfuscated, preventing outside observers from determining which transactions belong to which wallet addresses.

This allows users to transact with other parties, and none of them can see each other's wallet balances or transaction histories. This is very much in line with our expectations for regular fiat banking transactions, and conforms to the historical privacy expectations we have with respect to finance and eCommerce systems.

Masquerading as Blockchain eCommerce

Like Bitcoin, the notable detracting point of Monero is the lack of a built-in eCommerce protocol at the blockchain level. Any use of the cryptocurrency as a medium of exchange for eCommerce still relies on a system built on a centralized middleware platform. As pointed out above, this has many negative points in regards to data privacy.

Many websites and apps now exist, which allow payment with cryptocurrencies. Sadly, the unfortunate reality is, with very few exceptions, that these are all just centralized platforms, where the cryptocurrency is just the selected payment option.

True Crypto-eCommerce

To truly evolve eCommerce onto the blockchain requires Satoshi’s unrealized idea of a protocol-level eCommerce platform merged with Monero’s privacy technologies. Satoshi’s 4 eCommerce functions in the deleted Bitcoin code would need to be realized.

- Users: Merchants need to be able to create an identity for themselves on the blockchain. Shoppers will want to see what products a merchant offers, and in combination with the Review system, merchants can build a reputation, to allow shopper confidence.

- Market: The market functions as a trustless “Bazaar”, where shoppers don’t have their details being collected, analyzed or sold by a middleware provider - just like walking into a shopping center in the physical world - the shopping center owner shouldn’t be collecting your information, and neither should the eCommerce platform. Each of the shopper’s purchases must be completely independent and unconnectable to any other purchase they might make on the platform.

- Products: Merchants must be able to list their products on the blockchain. The blockchain protocol must independently keep track of product information, quantities available, prices, etc. and allow customers to query those products, and purchase them. Ideally, merchants would be able to subsequently edit their product listings, such as to change the quantity available when they get new inventory.

- Review: A product review/feedback system would also need to exist at the protocol level, to permit shopper feedback and lead to a merchant reputation system.

This would allow merchants to list their products independently on a decentralized marketplace, where they sell directly via P2P protocols to shoppers. Ideally, the only customer data to be shared is the minimum information needed for the product to be shipped to the customer, and the only person to receive that information is the merchant selling the item.

An Impossible Task?

Creating a blockchain with the combined capabilities of an independent, decentralized eCommerce platform, whilst maintaining the privacy expectations of the average real-world shopper sounds like a difficult task. Satoshi, himself, found the task insurmountable. Monero, by all accounts, never attempted to achieve it.

However, a community-driven open-source cryptocurrency project has been working on achieving this exact solution. With a small team of dedicated developers, the Safex blockchain was initially launched in 2018. The Safex devs forked Monero code and built their own 2-coin cryptocurrency on the CryptoNote protocol, keeping both Ring Signatures and Stealth Address technologies for privacy.

Then, from 2018 until December 2020, Safex created, tested and implemented an eCommerce suite into the Safex blockchain code, incorporating all of Satoshi’s unrealized eCommerce functions, along with additional protocol functions.

Satoshi’s eCommerce Aspirations Realized in the Safex Marketplace

So, 12 years after Bitcoin launched, and 6 years after Monero launched, the Safex Marketplace went live. The Safex core protocol includes the following eCommerce-related functions:

- Merchant Account Creation/Edit

- Item Listing/Edit

- Purchase

- Feedback Review (by Purchasers only)

- Price Peg Creation/Update

In order to attract Merchants to the platform, the Marketplace operates with a low, flat-rate 5% fee on each sale, which is automatically deducted at the time of purchase, and the remaining 95% is immediately sent directly to the merchant’s Safex Wallet. No waiting days or weeks for payments to arrive. Lower platform fees should also provide opportunities for increased competition, leading to lower prices for shoppers.

All purchases are made in the blockchain’s native currency, Safex Cash, and the 5% marketplace fee is distributed to all eligible Staked Safex Tokens, being the utility coin of the Safex blockchain, and also used to create Merchant Accounts.

The Price Peg feature allows merchants to list their items in their local fiat currency. As the value of Safex Cash fluctuates due to market forces, the amount of Safex Cash required for the purchase is updated regularly through the price oracle, to reflect the advertised fiat price of the listed item.

Safex Foundation, the not-for-profit entity supporting the Safex project, maintains several Price Peg oracles (currently USD, CAD, GBP), and has also created a library of articles to educate new users of the Safex blockchain.

With the blockchain being open-source and self-sustained through Proof-of-Work mining, third party software developers can choose to use the Safex blockchain as a free “always on” eCommerce engine, to drive their customer-facing, user-friendly eCommerce interface. It takes time to build upon these technological foundations. When the WorldWideWeb launched in 1990, it took about 5 years to see the emergence of Amazon and eBay.

The first company to build on the Safex blockchain, TWM Inc, launched their first Safex.Market Wallet with an integrated marketplace in March 2021. Work is currently ongoing to improve their Minimum Viable Product (MVP) stage Wallet, but even in this early point of development, products listed on Safex.Market during the last 15 months have already exceeded $4 million, with hundreds of purchases.

Additionally, some big names in the eCommerce world are testing the system during this pilot phase of the software, with Amazon heavy-hitters Watchmaxx and Focus Camera already trialing the Safex.Market app with a handful of their products.

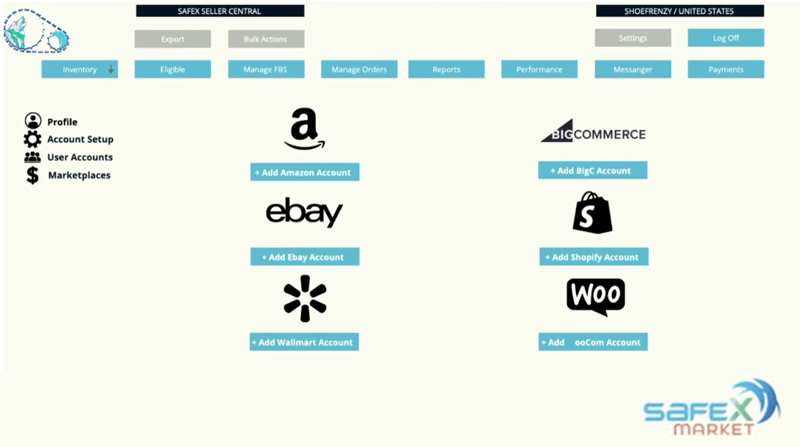

Initial focus by the Safex.Market team has been on the creation of a Merchant dashboard for onboarding Amazon FBA Sellers, but their roadmap envisions a platform able to easily integrate with multiple existing eCommerce channels.

Successful development of an easy-to-use interface for existing merchants will facilitate an ecosystem approaching readiness for mass adoption.

The Safex.Market Wallet won't be restricted to just established eCommerce merchants either. The upcoming v.2 version of the Wallet will allow anyone, anywhere, to list their goods and services for sale, and have global reach.

Shopper Privacy

Within the Safex.Market Wallet, shopper privacy is assured through the use of an encrypted (RSA4096) messaging system, which automatically creates a P2P message instance between the shopper and the merchant for each item purchased, using their PGP keys.

This achieves a messaging interface that ensures complete privacy, with only the necessary shipping information being sent directly to the merchant, and no other party can access it, collate it, sell it, or have it hacked and stolen.

Final Thoughts

I’ve already used the Safex.Market Wallet in its MVP form, and it's an easy to use, privacy-focussed eCommerce interface. Future improvements will only enhance the experience, and make it easier for novice users to feel comfortable.

If the Safex.Market team achieves their goals, then eCommerce on the blockchain - Crypto-eCommerce - has the capability of reshaping the future online shopping landscape.